Dream It. File It.

Build It.

LLC, S Corp, C Corp or Nonprofit. You choose.

We’ll help you launch with clarity, conviction, and not a single hidden fee.

Choose the Business Structure That Matches Your Goals

Form Your LLC — for $0 + State Fee

Protect what’s yours. Grow what’s next. Build your business without breaking the bank.

Classify as an S-Corp for Tax purposes

S-Corp is a tax move, not a business type. Talk to your CPA.

Build to Scale With a C-Corp

The launchpad for venture-backed dreams, equity plays, and limitless potential.

Create Change With a Nonprofit

For founders who turn passion into purpose. Your mission. Our know-how.

1M+ Founders Can’t Be Wrong. Here's Why They Start with Bizee

Start for $0

We file your formation for free. You just cover the state fee. That’s it.

Fast & Frictionless

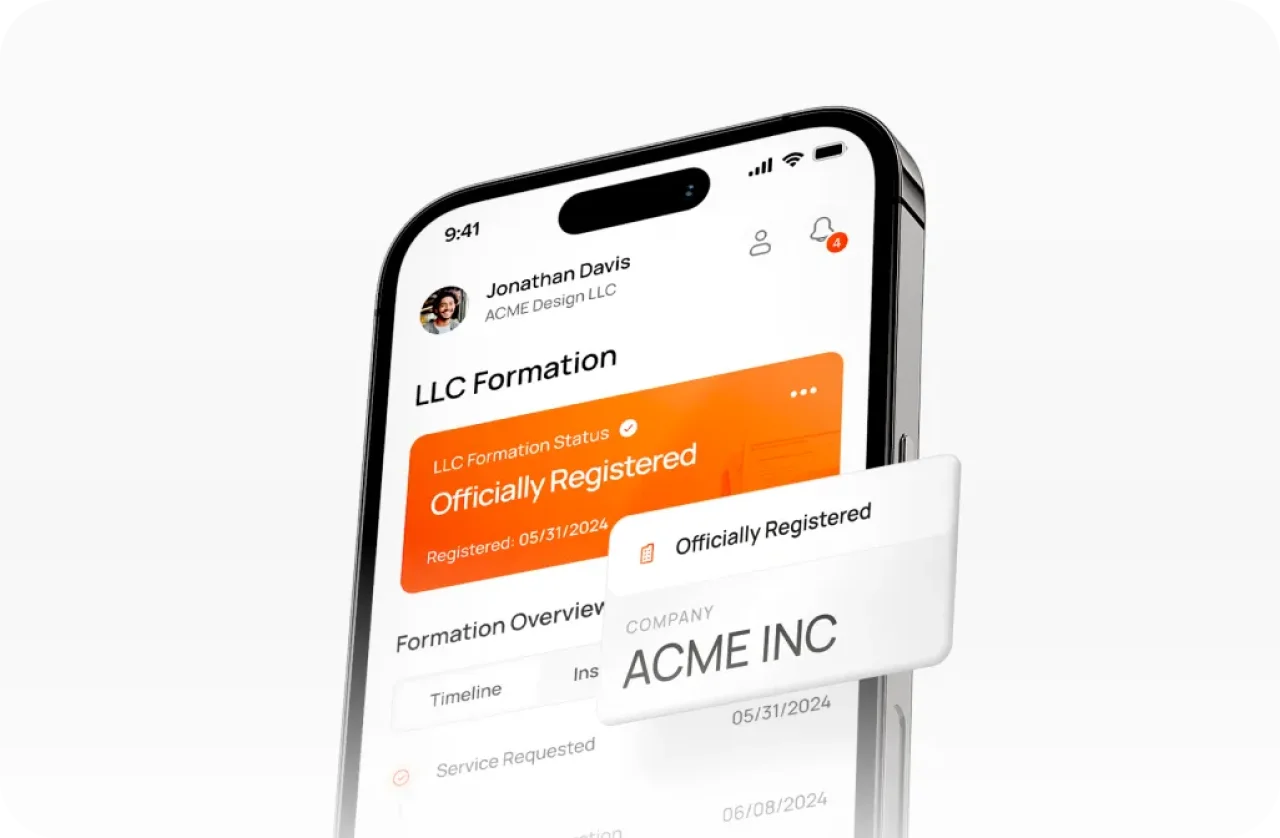

Form your business in minutes. No red tape. No hold music. Just momentum.

Privacy Comes Standard

We include a full year of registered agent service and shield your personal address.

Backed by Experience. Built for Entrepreneurs

Two decades in business. Founder led Independently owned.

From Idea to Entity in

Just 3 Steps

Choose Your Business Type. Not sure what fits? We break it down in plain talk, zero jargon.

Answer a Few Quick Questions. Tell us the essentials. We’ll handle the fine print and paperwork.

We File with the State. Fast, accurate, and compliant because nothing kills momentum like waiting.

Got Questions? We've Got Answers.

-

LLC vs. Corporation at a glance:

LLC (Limited Liability Company)- Offers limited liability protection—your personal assets are shielded from business liabilities.

- Simple structure and ideal for small teams or solo founders.

- Pass-through taxation: profits and losses flow through to your personal tax return.

- Minimal formalities—no annual meetings or boards required.

Corporation (C‑Corp / S‑Corp)

- Also provides limited liability.

- C‑Corp: subject to double taxation (corporate profits + shareholder dividends), more formal structure, can issue multiple stock classes—great for scaling and raising capital.

- S‑Corp: avoids double-tax with pass-through earnings, more compliance (max 100 shareholders, one stock type).

In short: choose an LLC if you’re launching a small, flexible business. Choose a corporation if you're planning to raise investment and grow big.

-

Timeframe varies by state: filing can take a few days to several weeks. Bizee can expedite the process with next-business-day paperwork filing.

-

Yes—Bizee's Basic package is $0 plus state filing fees. Bizee covers all service costs; you only pay what your state requires. No hidden fees, no surprise add-ons.

-

Most entrepreneurs choose to form in their home state, where they mainly operate. That's the simplest, avoids foreign qualification. However, some choose states like Delaware due to its business-friendly laws (for larger or investment-seeking companies). Bizee offers state‑by‑state guides to help you decide.